How you can buy real estate (at a quarter of the retail price) with this special situation

Dear reader,

A few years ago, I stumbled upon this tiny little company that’s perseveringly trying to develop some major assets. I’ve been following its developments ever since.

A few years ago, I stumbled upon this tiny little company that’s perseveringly trying to develop some major assets. I’ve been following its developments ever since.

Greenbriar is quite a unique company. Let’s call it a ‘special situation’ for lack of better words.

After almost a decade of disappointments and delays, unmet targets, and many unfulfilled promises, the general perception around this stock is at a low.

Perception is one thing and while I do understand its importance, that’s not what has actually happened in the background IMO throughout all these years.

An example of that would be Greenbriar’s wholly-owned 138 acres of land, located in Tehachapi, Southern California. The Sage Ranch land was bought for just one million dollars (around the height of the US real estate crisis in 2011). Just 2 months ago, that land alone was independently valued at 111 million USD (139 million CAD). In my opinion, that fact on its own warrants 3 times the current market cap (39 million CAD)!

But that land value will still remain hidden for a while: accounting rules require the company to book the land at its acquisition cost, not at its current value. So in order to unlock its true value, the company has to sell it. And that is about to start relatively soon.

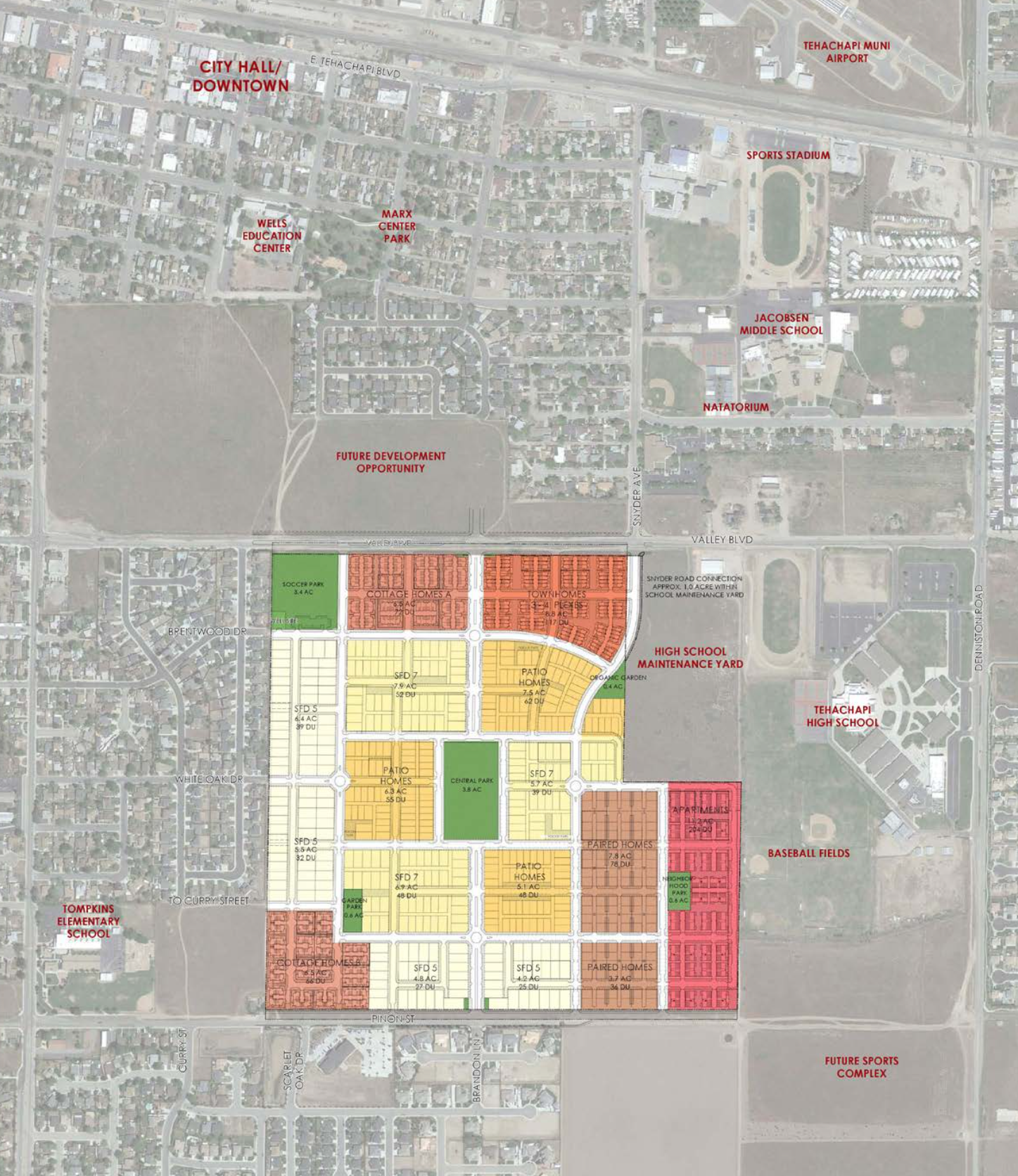

The company will not sell the land, however. Instead, it will build 995 reasonably affordable houses on it between 2023 and 2028. Sage Ranch is excellently located in Tehachapi. Schools and recreation areas are all within walking distance. A Walmart Supercenter and several restaurants are only a 5′ drive away. Last but not least: major military and tech employers are a 45 to 60′ drive.

Last week a major milestone for the realization of the project was achieved. Greenbriar announced a 40 million USD financing for its 435 million USD Sage Ranch real estate project.

This means that the first of 7 construction phases could start relatively soon (breaking ground is expected around the summer of 2022). As offers for home sales can also be officially accepted by then, this could mark the beginning of (slowly) unlocking the first hidden value. It will also bring in the first-ever meaningful revenues for the company.

But also let’s not forget the risks. One major risk for the real estate project here is the fact that mortgage rates are rising as of last month. This will surely impact the real estate market as it will get more expensive for homebuyers to obtain a mortgage.

Another risk is the illiquidity of Greenbriar’s stock. Due to its tiny size and fairly large insider ownership, it’s not easy to build a position in the stock or exit it. Therefore I think that if you’re interested in the company, it’s wise to keep your position (very) limited in size.

Greenbriar has more to offer than a real estate project alone. Two other examples of hidden value here would be their two solar farm projects.

Let’s take a deep dive into what ultimately matters for shareholders: delivering value. The CEO has done it before and I can see a handful of catalysts here for the rest of 2022 and beyond: breaking ground on Sage Ranch, starting sales for the first 144 houses, uplisting to a better exchange (Nasdaq), and possibly news about the two large solar farms.

Hope you can all appreciate the efforts that we’ve made in bringing this story and the CEO interview exclusively to you.

Presentation from the author for Spaarvarkens.be

https://spaarvarkens.be/wp-content/uploads/2022/04/Greenbriar-Introduction-March-2022.pdf

Interview – Q&A session with Mr. Ciachurski

https://www.youtube.com/watch?v=wLX1Azp0pLc&t=4s

Stock chart for TSXV: GRB

https://www.tradingview.com/chart/?symbol=TSXV%3AGRB

Greenbriar’s corporate presentation

Master Plan for Sage Ranch (995 affordable housing units in Southern California)

https://greenbriarcapitalcorp.ca/site/assets/files/5656/sage_ranch_fmdp_6-25-21.pdf

Hi Sven,

lijkt dat er 28 maart een aanpassing voor Nasdaq is ingediend? https://sec.report/Form/20FR12G

Algemeen: zijn er argumenten om een voorkeur te hebben voor de US of Canadese notering?

Groeten,

Jan

Dat is correct, Jan. De 20FR12G-filing van 28 januari 2022 (https://sec.report/Document/0001062993-22-001742/) werd geupdate op 28 maart 2022 met een amendement. Het is dezelfde filing, maar dan met een reeks van wijzigingen en updates (20FR12G/A): https://sec.report/Document/0001062993-22-008684/

Een uplisting naar Nasdaq zou een grotere visibiliteit voor het aandeel en het bedrijf kunnen betekenen. Momenteel noteert Greenbriar op de TSX-venturemarkt (symbool: GRB), maar ook op de OTC-markt in de VS (symbool: GEBRF). Beide hebben een hele lage liquiditeit, maar ik geef de voorkeur aan de thuismarkt op Toronto.