Greenbriar: Analyzing Free Cash Flows for a Conservative Company Valuation

The Market Challenges – The U.S. faces a national shortage of affordable homes – at current prices and mortgage interest rates, fewer than 5% of Americans can afford to buy a house today. And only 13% of the energy to power America’s homes comes from wind and solar. Greenbriar is focused on helping solve both of these deeply related challenges.

Why Greenbriar – The founder’s vision to empower affordable green housing began with his success building Western Wind, a CAD 420 MM asset sold to Brookfield. Since then, Jeff Ciachurski has broadened the company’s focus from building renewable energy to include solving affordable green housing – both are pressing national issues where Greenbriar has a proven ability to solve the common challenges these asset classes present: optimum site location, regulatory permitting, solving the technical aspects of design and construction, navigating local politics, and hands-on project management.

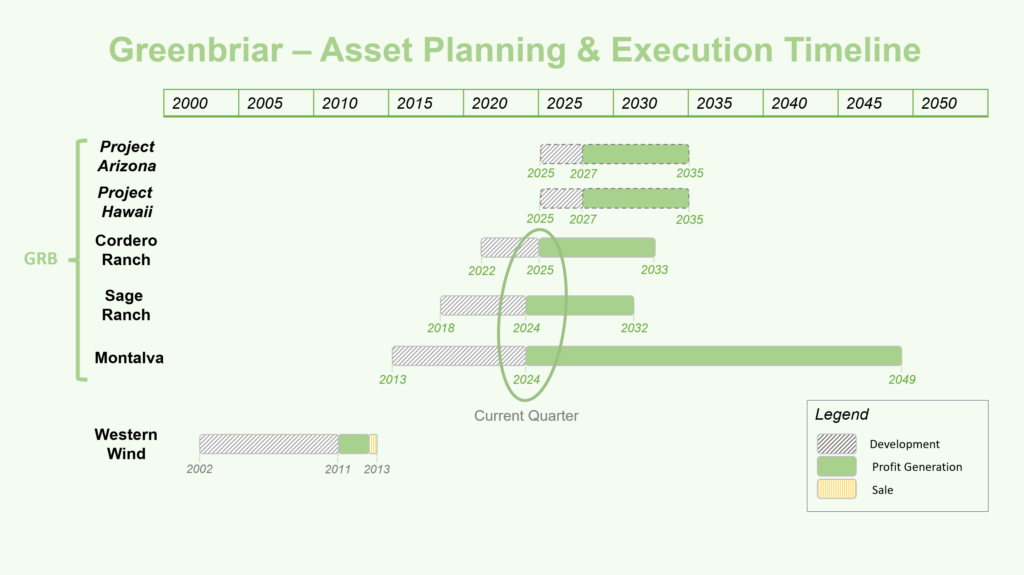

The timeline below shows Greenbriar’s asset portfolio shifting now from development to revenue generation, and two projects under active review:

Why now – The company is delivering on significant milestones across all three assets this quarter: final approvals for the largest solar farm in Puerto Rico, breaking ground on a large-scale (995 units) affordable green housing asset in Southern California, and a partnership agreement on an even-larger green community in one of the fastest-growing towns in Utah.

What Makes Greenbriar Different – The CEO rolls up his sleeves and owns every detail of what they build. Greenbriar isn’t trying to be huge – they believe they can only build a great medium-sized company one community at a time. Greenbriar treats their shareholders like they are their partners and bosses. Finally, they are realistic and transparent. Most companies try to dazzle investors with rosy management forecasts, and then underperform. Greenbriar uses conservative third-party estimated cash flows, from the leading industry experts that lenders and regulators rely on. The company aims to beat them, and to keep their investors fully informed along the way.

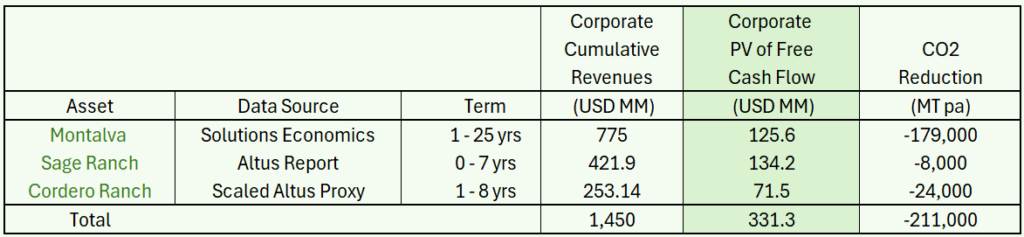

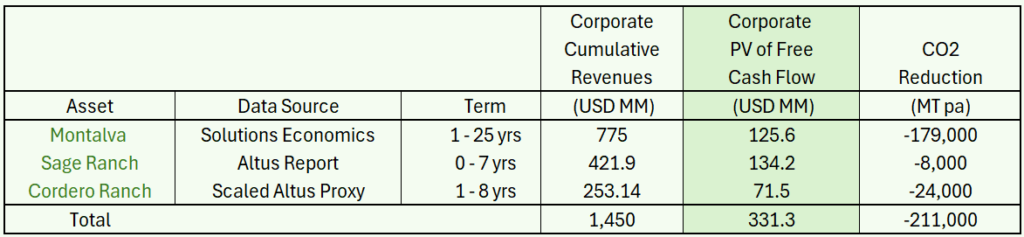

How You Can Participate – The table below shows the key financial and environmental metrics for Greenbriar:

USD amounts in millions, MT pa: metric tons of C02 per annum, PV: present value, FCF: free cash flow.

Note that the above conservative third-party estimate of the present value (PV) of corporate free cash flow (FCF) of USD 331.3 MM = 15.6X the company’s current market valuation. In addition to your pro rata ownership of the corporation and its metrics above, Greenbriar is also committed to paying its shareholders a quarterly dividend equal to 35% of the free cash flow. This will provide a healthy annual return on your investment, while also leaving sufficient resources for Greenbriar to fund its pipeline of growth opportunities, buffer any downside, and avoid dilutive equity raising in the future.

This analysis summarizes the following aspects of Greenbriar’s business and vision:

3 – Overview of Greenbriar’s portfolio key metrics and summary profiles of each asset

4 – Pipeline of future projects

5 – The company is achieving significant milestones this quarter across all three properties

6 – What makes Greenbriar different?

7 – Valuation – conservative third-party base case and sensitivity analysis

8 – Distribution policy of corporate free cash flow as shareholder dividends

Let’s start with the challenges that Greenbriar is working to solve.

1 – THE MARKET CHALLENGES – NATIONAL SHORTAGE OF AFFORDABLE GREEN HOUSING AND THE CLEAN ENERGY TO POWER IT

The U.S. faces a national shortage of affordable homes – at current prices and mortgage rates, only 5% of Americans can afford to buy a house today. The other 95% are priced out of the American Dream due to high housing prices (national average: USD 430,000), high interest rates (current 30-year mortgage rates are near 8%), and supply challenges. Nearly 70% of existing home owners took advantage of low financing rates in 2018-2021, and are thus rate-locked into their current residence. Much of the marginal supply from retiring baby boomers is too big (>3,500 sq ft), in the wrong location (Northeast and Midwest U.S. regions), or too expensive for the current buyers. Within this priced-out buying group are college graduates, down-sizing seniors, and military veterans, and these large cohorts have driven up rents nationally. Americans are currently faced with choosing between mortgage payments they can’t afford, high rents which build no equity, or neighborhoods they don’t want to live in.

California is a compelling example with 39 million official residents and a median family home price of USD 830,000. The Golden State has an estimated shortage of 3.5 million affordable homes. Because of this shortage and sharply higher interest rates, the state is experiencing a legal population decline for the first time in its history. In addition to requiring affordability, many home buyers are also looking to live “greener”, and would prefer a more sustainable environmental footprint in their homes, their cars, and the energy sources that power them. Only 13% of the energy to power America’s homes comes from wind and solar. Greenbriar is focused on helping solve both of these interrelated challenges.

2 – THE GREENBRIAR SOLUTION

Upon completing the Western Wind Sale, Greenbriar began developing the medium-scale solar energy which Puerto Rico critically needs, and the company has been actively developing the Montalva asset for almost a decade. The value of this asset is driven in part by the fact that Puerto Rico has extremely high energy prices, and also that a choice location like Guánica has extremely high solar radiation. This allows for a 144 MWh battery design with a very high DC to AC ratio, to help solve the local energy challenge while producing triple the revenue compared to a solar farm on the mainland.

Since building solar and wind farms requires significant expertise in real estate, Greenbriar has expanded its focus to add affordable green housing to their portfolio of assets. This is a pressing national issue where Greenbriar has a proven ability to solve the common challenges this asset class presents – optimum site location, navigating local politics, regulatory approvals and permitting, technical aspects of design and construction, and hands-on project management.

Greenbriar builds their housing assets with smaller physical and environmental footprints through community design and local approvals. The high-quality homes, ranging in size from 750 sq ft to 2,700 sq ft (70 m2 to 251 m2), are inside high-end planned neighborhoods with dramatically lower energy usage due to optimal street design and best-in-class solar installations. At the Sage Ranch development for example, the average home will be 1,600 sq ft (149 m2) in size, USD 448,000 in price, monthly payments of as low as USD 1,800, and a 40% lower carbon footprint than the average U.S. home. To further improve the buyer economics, Greenbriar has located the Sage Ranch community within the U.S. Department of Agriculture mortgage overlay, which means the USDA will finance a home at or below their published rate of 4.125% over 38 years with zero down payment. Some local USDA rates are as low as 1.9%. This contrasts sharply with interest rates at 7.9% for a 30-year fixed-rate conventional mortgage.

At Cordero Ranch, Greenbriar will build high-quality homes inside a full-service community, with a starting home area of 650 sq ft (60 m2), allowing for a USD 200,000 starting product, giving a mortgage payment of USD 1,500 before any further government subsidies.

There is limited current competition because national builders are still catering to the 1950s dream of big homes and big yards. This type of product is neither affordable nor sustainable from a financial and environmental perspective.

3 – OVERVIEW OF GREENBRIAR’S PORTFOLIO KEY METRICS AND SUMMARY PROFILES OF EACH ASSET

Most companies try to dazzle investors with rosy management forecasts, and then underperform over time. Greenbriar uses conservative third-party estimated cash flows, from the leading industry experts that lenders and regulators rely on. And management aims to beat those estimates. The cumulative corporate PV of free cash flow is 15.6x the current market value of Greenbriar. On the environmental impact front, the annual CO2 reduction across this portfolio is the equivalent of removing 44,000 cars from the roads or planting 8.4 million trees.

The table below shows the three properties, their data sourcing, and the key financial and environmental metrics:

USD amounts in millions, MT pa: metric tons of C02 per annum, PV: present value, FCF: free cash flow.

Note the Corporate PV of FCF of USD 331.3 MM = 15.6X the current market value of Greenbriar.

SUMMARY PROFILE OF EACH ASSET

MONTALVA SOLAR – Guánica, Puerto Rico – GREEN ENERGY – APPROVED by PREPA

The Montalva property is a large utility-scale solar and battery storage build with an initial size of 80 MWac or 160 MWdc, (which is about 320,000 solar panels) located in the very sunny and dry southwestern coastal area of Puerto Rico.

The Caribbean island is under the ownership and economic supervision of the United States, primarily through the Financial Oversight and Management Board. High local electricity prices provoke anger and dismay from the local population. This is an island that is still fighting the aftermath of Hurricane Maria from 2017. At that time, a substantial part of the outdated electricity network was completely destroyed. The island’s 3.2 million inhabitants live with a 52% higher retail energy rate compared to the average in the entire USA, with further increases in the energy cost for residents coming over the next several decades.

Currently, the price per kWh is one of the highest in the U.S. and its territories. The problem is caused by the local utility burning expensive crude oil in old and highly inefficient steam plants to make 60% of the island’s electricity. The facility can become the most ambitious in the Caribbean and thus form part of the solution both economically and physically. Montalva will supply electricity to 30,000 households.

The annual revenue at Montalva is conservatively expected to be USD 31 million (CAD 41 million) per annum over 25 years for a cumulative total of USD 775 million (CAD 1.05 billion), and the asset will generate a present value of free cash flow of USD 125.6 million. The environmental improvement of Montalva’s solar energy, replacing the fossil fuel-heavy electricity Puerto Rico has been reliant on, is expected to put 179,000 fewer metric tons of CO2 into the atmosphere each year. That’s the equivalent of one fewer annual auto emission amount for every family Montalva brings power to.

SAGE RANCH – Tehachapi, California – GREEN HOUSING – APPROVED & BREAKING GROUND

Sage Ranch is a real estate community of 995 exceptionally located entry-level homes in the heart of Tehachapi Valley, a community located in southern California with 38,000 residents, 80 minutes north of the City of Los Angeles. Planned for Greenbriar as a sustainable community by the renowned JZMK Partners, Sage Ranch consists of a mix of detached houses, cottage homes, townhouses, and apartments.

The community has a central park and clubhouse, nine additional parks, and sports and recreational facilities. From an environmental standpoint, Sage Ranch has a near zero carbon footprint due to schools being immediately adjacent to the property boundaries, a seven-minute walk to town, solar-powered rooftops, smart meters and electric charging stations, recycled building materials, energy-efficient appliances, and recycling of gray water.

The annual revenue at Sage Ranch will vary over the asset’s 7-year life – cumulative revenue is conservatively expected to be USD 422 million, and the asset will generate a present value of free cash flow of USD 126 million. The environmental improvement of the more efficient community layout and home design is estimated to be 8,000 fewer metric tons of CO2 into the atmosphere.

CORDERO RANCH – Cedar City, Utah – GREEN HOUSING – ANNOUNCED

In October 2023, Greenbriar announced a joint venture where Greenbriar will build and develop a 1,361-acre 3,500 home sustainable community subdivision in Cedar City, Utah. Cordero Ranch is located in one of the fastest growing regions in the USA and Cedar City was ranked #8 as the most dynamic micropolitan area in the entire USA. The price range at Cordero Ranch will start at USD 200,000 for a 650 sq ft (60 m2) home, allowing recent graduates, veterans, and seniors to own the lowest cost, recession-proof new homes in the entire USA. As lead partner and manager of the Cordero Ranch build, Greenbriar will have a 20% carry in the results of Cordero Ranch, which will be represented in their ongoing financial statements.

Greenbriar’s share of the present value of free cash flow is USD 72 million. The environmental improvement of the more efficient community layout and home design is estimated to be 24,000 fewer metric tons of CO2 into the atmosphere.

4 – PIPELINE OF FUTURE PROJECTS

Greenbriar’s core focus is profitably executing on the build-out of the assets currently in its portfolio. The company is also regularly exploring additional projects that fit within its mission of empowering green housing. Several are under active review in Arizona, Hawaii, and Puerto Rico. As Greenbriar proves their economic and environmental fit within its business model, they will selectively add them. This gives Greenbriar shareholders a stake in the current assets and an ongoing interest in the broader green housing transformation.

5 – THE COMPANY IS ACHIEVING SIGNIFICANT MILESTONES THIS QUARTER ACROSS ALL THREE PROPERTIES

In the next three months Greenbriar will (1) receive the final approvals for Montalva, (2) break ground at Sage Ranch, and (3) finalize their partnership for Cordero Ranch in Utah. The table below shows the timelines for each of these assets as they shift from the development stage into revenue generation within the next year, and it also includes two lead pipeline projects in Arizona and Hawaii.

6 – WHAT MAKES GREENBRIAR DIFFERENT?

Founder Jeff Ciachurski built Western Wind Energy, a renewable electricity company that he sold to Brookfield for CAD 420 million, and he is deeply committed to the success of Greenbriar. After his Western Wind exit, he immediately started Montalva to help Puerto Rico solve its energy challenges in a practical and profitable manner. As he proved with Western Wind, the CEO rolls up his sleeves and owns every detail of what Greenbriar builds. The objectives are realistic – building a great community and a cost-effective renewable power source take years of precision planning and execution. Management knows they can build a great medium-sized company, not a giant one. Greenbriar treats their shareholders like they are their partners and bosses. Finally, the company is very realistic. Greenbriar uses conservative third-party estimated cash flows, from the leading industry experts who lenders and regulators rely on. As Greenbriar moves into the future, they will carefully build a pipeline of additional assets which meet their exacting standards.

7 – VALUATION – CONSERVATIVE BASE CASE AND SENSITIVITY ANALYSIS

Greenbriar is a public company registered in both the USA and Canada and is subject to U.S. GAAP and IFRS accounting standards. Both reporting regimes are based on book values of important balance sheet and income statement items and do a thorough job of conveying a historical sense of company expenditures and performance. To give management and shareholders a more complete prospective view of the company, Greenbriar also provides conservative third-party estimates for their pro forma performance and the resulting cash flows, both at the corporate and shareholder level.

These conservative third-party estimates show a present value of corporate free cash flow of USD 331.3 MM, 15.6X the current market’s valuation, equal to USD 7.46 per share (CAD 10.07) using a fully diluted share count of 44.4 MM shares. This undervaluation is due to the backward-looking nature of accounting metrics, the current lack of research coverage from brokerage firms, and that the company hasn’t spent anything on investor marketing (unlike most small-cap companies). Given all of those aspects, a potential investor needs to do so much work to dig into the real value of Greenbriar, so a central purpose of this document is to do much of that work for you.

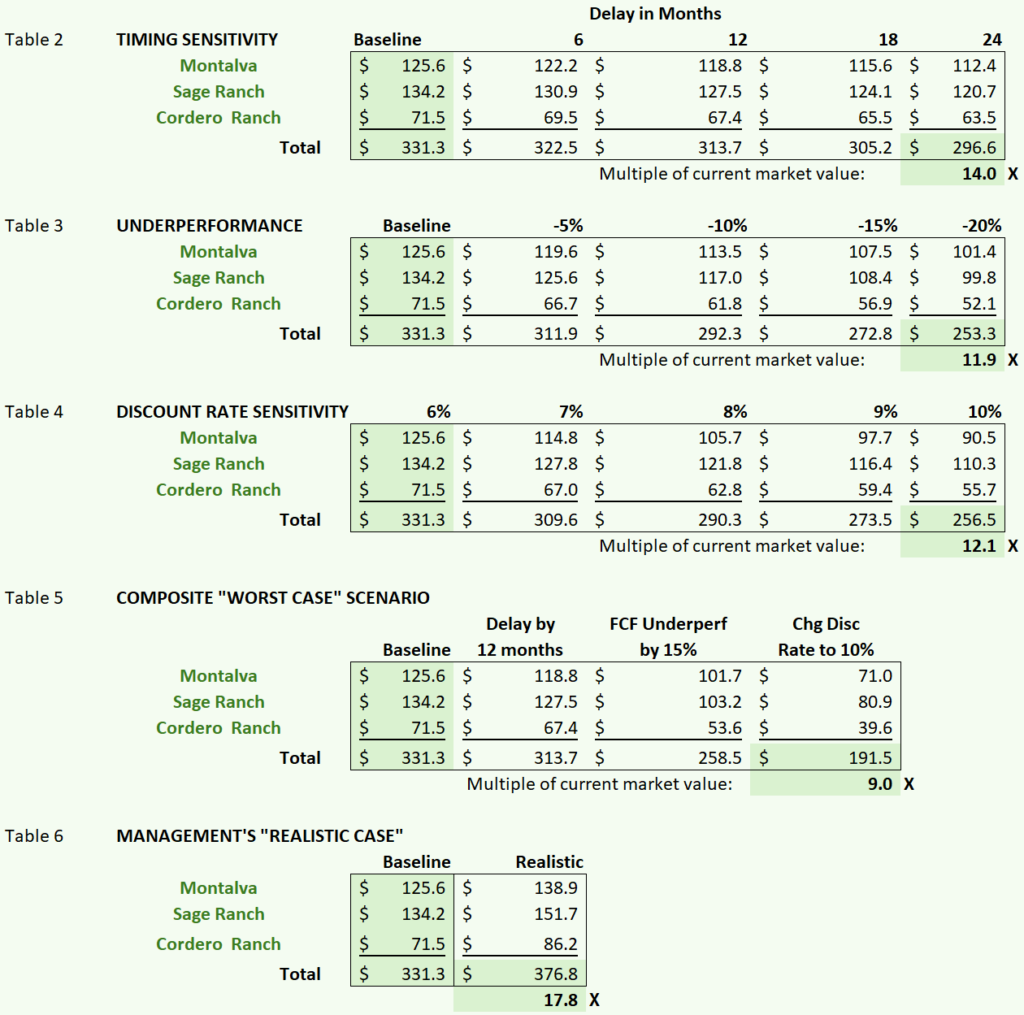

Sensitivity analysis of conservative baseline to downside scenarios, plus management’s realistic case:

In addition to this baseline third-party valuation, on the following page is a set of tables that show the corporate valuation impact of adversely adjusting three variables – project delays which would defer operating cash flows, underperformance of the portfolio of assets which would lower operating cash flows and increasing the risk assessment of operating cash flows by using a higher discount rate. Included in Table 5, you’ll find a “Worst Case” composite scenario where all three of those variables are adversely adjusted. Finally, given the conservative nature of the third-party estimates, I have included a “realistic base case” scenario which reflects management’s view of a more likely set of cash flows based on current market values for home prices and electricity rates. The outline below describes each table in more detail. Note that even these stressed downside scenarios result in a PV range of corporate cash flows of 9.0X – 14.0X the current market valuation of Greenbriar.

Table 2 – Timing Delay – Shows the effect on the PV of corporate free cash flow to a project delay (ranging from 6 months to 24 months).

Key Finding: Even with a 24-month delay, the PV of corporate free cash flow = 14.0X the current Greenbriar market valuation.

Table 3 – Underperformance – Shows the sensitivity of the PV of corporate free cash flow to potential underperformance of corporate free cash flow (from -5% to -20%).

Key Finding: If there is a 20% decline in annual free cash flow, the PV of corporate free cash flow = 11.9X the current Greenbriar market valuation.

Table 4 – Discount Rate – Shows the sensitivity of the PV of corporate free cash flow to a range of discount rates (from 6% – 10%).

Key Finding: At a 10% discount rate, the PV of corporate free cash flow = 12.1X the current Greenbriar market valuation.

Table 5 – “Worst Case” composite of adverse outcomes across all three variables – Adjusts baseline PV of corporate free cash flow by a 12-month timing delay, reduces corporate free cash flow by 15% underperformance, and then uses a higher 10% discount rate.

Key Finding: Combining a 12-month delay, 15% underperformance, and using a 10% discount rate, the PV of corporate free cash flow = 9.0X the current Greenbriar market valuation.

Table 6 – “Realistic Base Case” showing the aggregate per share impact of management’s current market estimates for construction costs, unit sales prices, and electricity rates.

Key Finding: Management’s likely operating scenario results in a valuation of 17.8X the current Greenbriar market valuation.

8 – DISTRIBUTION POLICY OF CORPORATE FREE CASH FLOW AS SHAREHOLDER DIVIDENDS

Greenbriar is committed to paying its shareholders a quarterly dividend equal to 35% of free cash flow. This provides a healthy return on your investment while ensuring sufficient resources for the company to fund growth opportunities, buffer any downside, and minimize dilutive equity-raising in the future.

In the interest of maintaining a realistic and conservative valuation approach, when we consider Greenbriar on a per-share basis, I use a fully diluted share count. This involves adjusting the current 34.1 MM outstanding shares upwards by assuming the conversion into common equity of all outstanding options, warrants, and convertible debt financing, for a maximum share outstanding of 44.1 million.

Looking only at expected dividends, and using the conservative third-party estimates of how the Greenbriar assets will perform, and a 6% discount rate, yields a discounted net present value of USD 2.45 or CAD 3.30 per share (3.9X current share price) in dividends alone, plus your pro rata ownership stake in the company, its additional future cash flows from new projects, and any upside from an exit. Greenbriar is currently trading at around 25% of this dividends-only valuation.

It is important to note that Greenbriar is in the midst of a significant phase shift in terms of its market capitalization and shareholder valuation. Right now, the stock price trades on a deeply discounted value of its portfolio of three assets, their conservative third-party estimated cash flows, and a 35% distribution policy commitment. This framework gives no value to the cash retained in the company, nor to the better-than-conservative credible management expectations for the current assets, nor to the future portfolio of properties that the company will develop and execute on.

Over time we can expect the stock to shift from a discounted value of specific finite cash flows (with a minimum value between USD 6-8 per share) to a more traditional corporate valuation using a multiple on current and expected earnings. As Greenbriar adds high-quality properties along the way, maintaining its portfolio to the size they can execute on to their standards, the valuation will shift into the USD 10-15 per share range (CAD 13.5 – 20).

OTHER SHARE CONSIDERATIONS

Listing details:

Greenbriar Sustainable Living, Incorporated has two stock listings. One on the OTC market in the U.S. (symbol: GEBRF). The main listing is in its home country, Canada, on the Toronto Venture Exchange (symbol: GRB). In the past, Greenbriar expressed its desire to list on a larger exchange, and steps have been taken to be listed on the NASDAQ Global Market Select. In 2022, the process for the NYSE American (formerly AMEX) was also initiated.

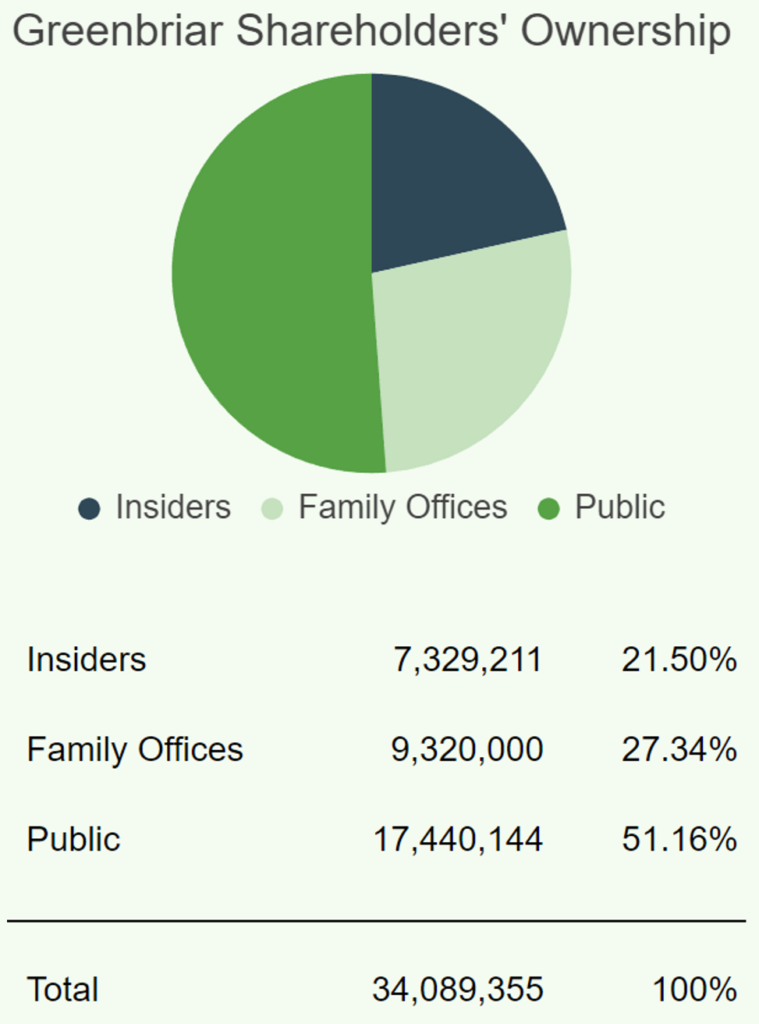

Summary of current shareholders:

Management and family own 21.5% of the shares, providing a significant incentive to be shareholder-friendly. The majority of the available outstanding shares are held by investors who are familiar with the potential of the projects and have been following the company for many years. These are the ‘strong hands’ whom prospective shareholders should want to join.

9 – EMISSION REDUCTIONS

As noted earlier, only 13% of U.S. electricity comes from solar and wind. Over 50% of a family’s carbon footprint comes from their home. Greenbriar is working to solve both of these challenges. The Montalva solar facility will add 320 MW to energy-challenged Puerto Rico’s grid, at a reduction of 179,000 metric tons of CO2 versus the island’s heavily fossil fuel reliant current power generation. Greenbriar’s real estate communities, with solar panels, lower water consumption, and efficient community layout, will reduce another 32,000 metric tons annually. In aggregate, this is the equivalent of removing 44,000 cars from the roads, or of planting 8,400,000 trees.

Most emissions reducing activities have unappealing and very long-term breakeven economics. And most attractive investments have meaningful carbon footprints. Greenbriar provides a rare combination: significant emissions reductions with attractive customer and investor economics.

10 – ASSET DEEP DIVES

Property Name: MONTALVA SOLAR

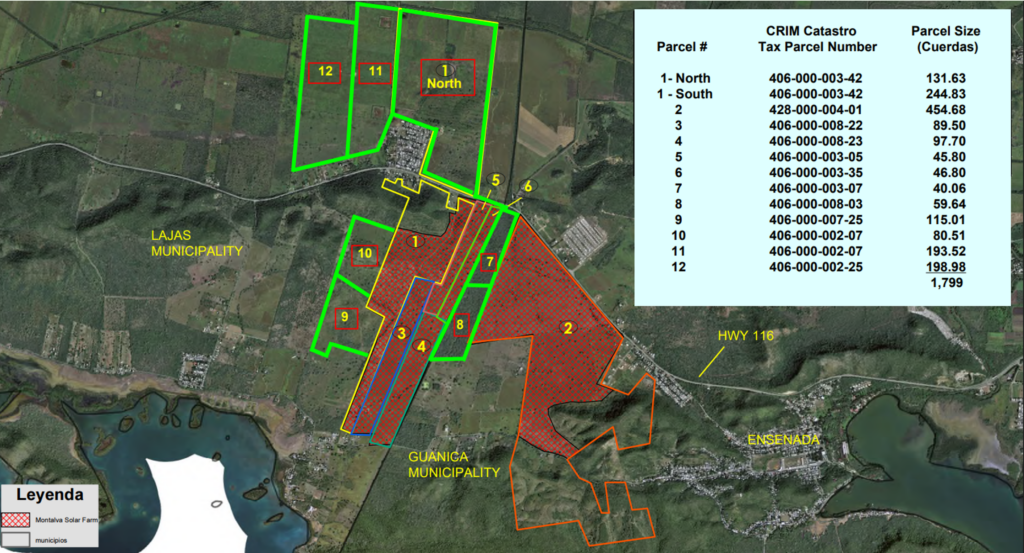

Site Map:

Location: Guánica, Puerto Rico; 17.975660, -66.961092.

Focus: Renewable green energy for the people of Puerto Rico.

Size: 320 MWac / 160 MWdc, sufficient to provide renewable energy to 38,000 homes and the largest solar facility in the Caribbean region. Total property size: 1,747 acres (1,799 cuerdas or 707 hectares).

Competitive Landscape: Puerto Rico adopted a Renewable Portfolio Standard on July 19, 2010 with the passing of Act No. 82. The act established goals to reach 12% of renewable energy by 2015, 15% by 2020, and 20% by 2035. There’s a political consensus that the current level of 3% renewables is well behind targets. With UV levels between 8-11 throughout the year, Puerto Rico is well-positioned to make use of its solar power potential. Furthermore, with its current fossil fuel heavy blend of energy sources, the addition of solar capacity represents a needed reduction in emissions, but to date, little progress has been made.

Summary Economics: Present value of corporate free cash flow of USD 125.6 MM (CAD 169.4 MM).

Environmental Impact: The Montalva solar facility will reduce CO2 in the atmosphere by 179,000 metric tons annually, when compared to Puerto Rico’s current coal and oil-reliant electric utilities. This is the equivalent of 37,000 cars off the road, or planting 7,100,000 trees.

Status: Received full Settlement Agreement from PREPA to approve the contract on October 3rd, 2023. Greenbriar is currently working on refining the details with PREPA and will then seek approval with the FOMB.

Timeline and Asset Lifespan: 35-year operating life from target start of commissioning.

Partners in Site Development:

– EPC Contractor: CMEC.

– Other Vendors: CATL, MEPPI, Siemens, Trina Solar, Jinko Solar, Norton Rose Fulbright (legal).

Key Regulators:

Puerto Rico Energy Bureau (PREB), Financial Oversight and Management Board for Puerto Rico (FOMB), U.S. Department of Natural and Environmental Resources, U.S. Department of Fish and Wildlife, Puerto Rico Aqueduct and Sewer Authority (PRASA), Municipality of Guánica and Lajas, OGDE, EPA, EQB.

Risks and Mitigants:

– Technological: The Tier 1 PV solar panels and storage to be installed will be at the high end of industry standards for output, reliability, and durability. Panels rate at 500 Watts DC at 1,000 Volts and 21% efficiency, with battery storage, multiple sun-tracking methods, state-of-the-art SCADA facility control system, and optimized to 2:1 DC to AC ratio for the most efficient/complete solar capture.

– Changing Governmental Support, potentially in the form of price renegotiation. The island is well behind the renewable targets outlined above (currently at 3% versus a target of >15%). Both political parties support more renewables, and there is a scarcity of projects underway. Montalva is the only project actively planned. Montalva’s offtake agreement provides energy at less than 50% of the island’s current retail electricity cost. Finally, recent regulatory approvals for Montalva provide for higher electricity prices than are currently modeled and represented here.

– Weather/Hurricane: The facility is covered by insurance.

Economic Details and Valuation:

Third-party source for forecasted asset economics – Report by Solutions Economics, authored by Professor Leonardo Giacchino who has 25 years of experience, on over 100 projects in 30 countries, conducting due diligence and feasibility studies for power plants, utilities, and pipelines. His bio can be found here.

Total Greenbriar Asset Revenue: USD 775.0 MM.

Discounted Greenbriar’s Present Value of Free Cash Flow: USD 125.6 MM (using a 6% rate for consistency with other assets, versus Solutions Economics’ rate of 4.87% which would drive a USD 139.7 PV of free cash flow).

Property Name: SAGE RANCH

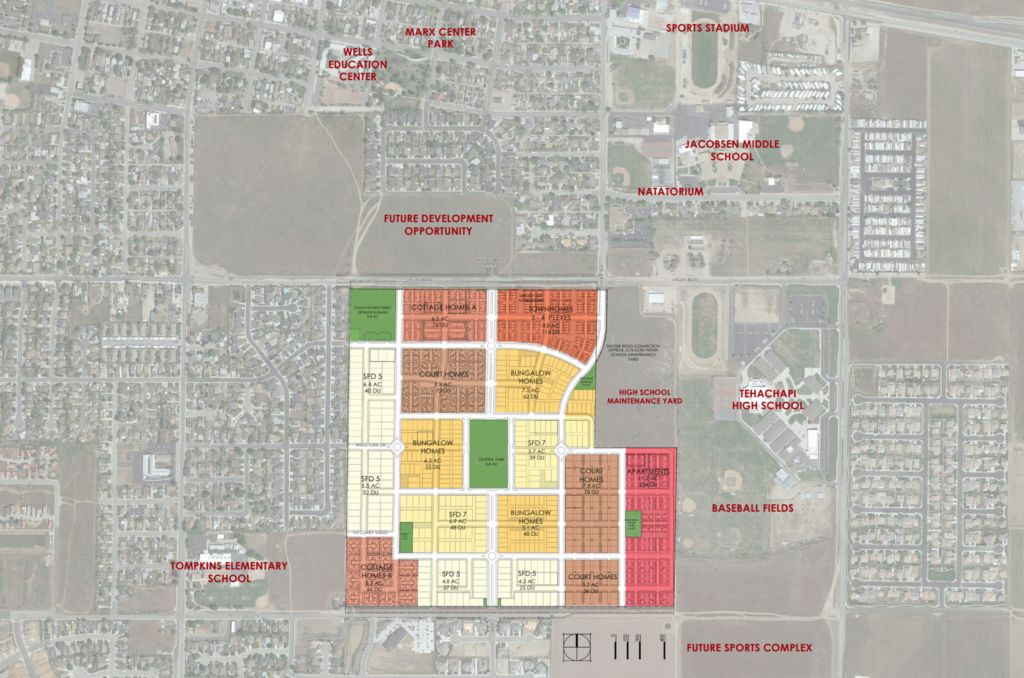

Site Map:

Location: Tehachapi, California; 35.120834, -118.439139.

Focus: Affordable green housing for the supply-challenged Southern California market.

Size: 138 acres (55.8 hectares) for 995 units.

Competitive Thesis: There is a significant and well-reported housing shortage in the state, and in particular in the southern portion. The current Tehachapi housing market has an average price of USD 447,000, an average home age of over 20 years, and would require repair work for a new buyer. Approximately 750 houses trade each year. Sage Ranch’s brand-new units will have an average price just below that at USD 437k, with a range between USD 299k and USD 549k, and Greenbriar will be selling an average of 150 units per year over the 6.5-year sales cycle for the property. Proximity to major regional employers and government installations provide ample would-be buyers.

Sage Ranch is a planned community with an orientation to smaller lots, walkability, and shared amenities characterized by a blend of new urbanism and traditional values. Designed with resource conservation and the historic charm of the great American communities in mind. Eight different styling options provide buyers with plenty of flexibility for their lifestyle and budget. Smaller lots incentivize community development; orientation to garden, patio, and porch spaces foster community interaction, and smaller personal yards demand less maintenance, water, and energy.

Summary Economics: Present value of corporate free cash flow of USD 134.2 MM (CAD 181 MM).

Environmental Impact: Sage Ranch minimizes the community’s environmental impact, at a reduction of 8,000 metric tons of CO2 annually versus conventional housing. Solar panels on every home, smaller personal yards with careful selection of low water consuming plants, plus shared amenities such as clubhouse, tennis courts, and pool, foster community and will lower aggregate energy and water consumption.

Status: Break ground on April 1st, 2024 for first phase construction.

Timeline and Asset Lifespan: 6.5 years, from early 2024 initial phase of home sales to late 2030 final sales phase.

Partners in Site Development:

JZMK Partners (planner), Strong Engineering & Design (architect), DeWalt (engineering), Richard Phillips Homes, Alexander & Assocs (engineering), California Utility Consultants, Bashan Management, Nova Group, California Builder Services.

Key regulators: City of Tehachapi, California Department of Real Estate (DRE), State of California.

Risks and Mitigants:

– Decline in Demand: Unlikely given the size of interested home owners in the vicinity, plus incremental job growth at nearby employers, and entry-level pricing at 50% of the price of the average California home.

– Increase in Supply: Limited land availability and challenging permitting obstacles restrict new supply coming onto the market.

Sage Ranch Promotion Clip:

Economic Details and Valuation: Third-party source for asset economics – Altus Group Expert Services, a recognized industry leader in real estate diligence and valuation. The report was created for the lender, so should be considered conservative. Using the latest version from January 2024.

Total Greenbriar Asset revenue: USD 421.9 MM (net of 6% sales agent fee).

Discounted Greenbriar’s Present Value of Free Cash Flow: USD 134.2 MM (using a 6% discount rate).

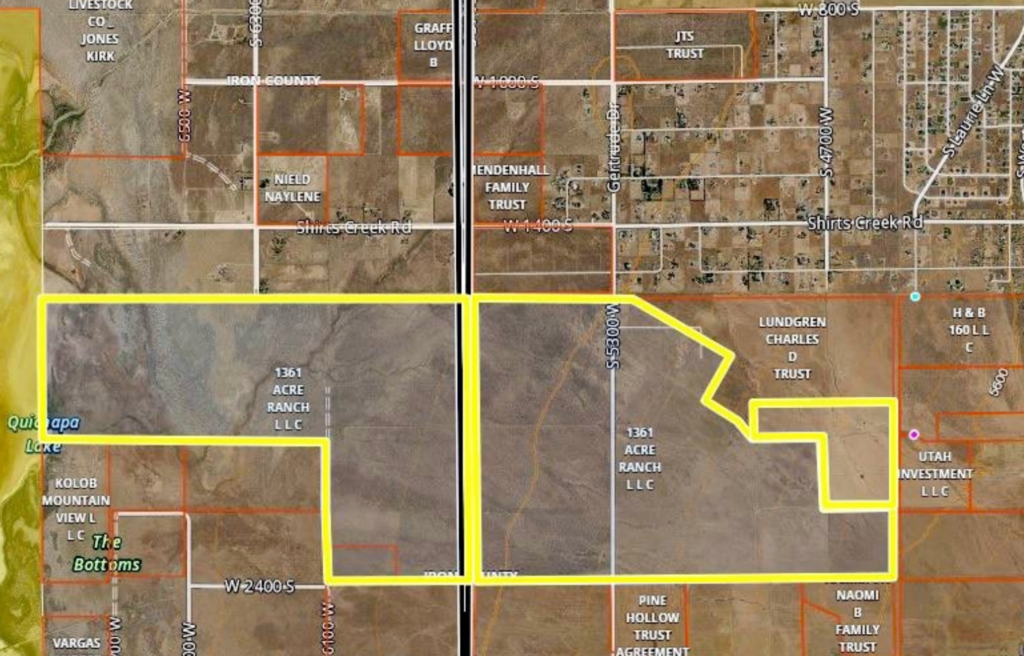

Property Name: CORDERO RANCH

Site Map:

Location: Cedar City, Utah; 37.638747, -113.156263.

Focus: Establish a large, self-contained high-quality, yet affordable, living community that inspires quality and recession-proof home ownership, mixed with a full-quality lifestyle setting, coupled with a demographic supportive of the environment: veterans housing, seniors, and personal security. Create a mixed-use community that encourages sensitive site design, provides ample recreation/open space amenities, and conserves and preserves natural resources. Solve the massive, unhoused problem in the United States.

Size: 1,361 acres (551 hectares).

Competitive Thesis: Affordability — High-quality, smaller footprint homes (starting around 650 sq ft) inside a full-service luxury community starting at USD 200,000, targeting a USD 1,500 monthly mortgage.

Competitive Advantage: The city has recently zoned large competitive and adjacent entitled parcels into ‘low-density’ zoning, giving Greenbriar the only large piece of real estate that can now use this updated set of zoning regulations for higher-density units.

Summary Economics: Discounted Greenbriar’s share (using 20% overall carry as lead project developer and sponsor) of the present value of free cash flow: USD 71.5 MM (CAD 96.4 MM).

Positive Environmental Impact: Conservation and preservation of natural resources in environmentally sensitive areas is a key component of the land plan. The plan ensures compatibility of new development with the existing environment, including encouragement of water conservation and smart green design. Integration of existing riparian corridors as open space will increase connectivity and pedestrian circulation.

Status: Planning and Permitting.

Timeline and Asset Lifespan: Roughly a 7-year horizon, starting in one year.

Partners in Site Development: Richard Phillips Construction, TS Media, Nerd Power.

Key Regulators: Cedar City, Iron County Utah, State of Utah.

Risks and Mitigants:

– Decline in Demand: Unlikely given the city’s growth and job growth at nearby employers, plus retirees moving in from nearby states due to the safe and welcoming community, at a full pricing level that is less than 50% of the price of where the retirees are coming from, plus the smaller models are 60% of the average price of new regular homes in Cedar City.

– Increase in Supply: Limited land availability due to water constraints. The landowner donated 775 acre-feet to the City and is guaranteed that amount to build homes.

Total Greenbriar’s Share of Asset Revenue: USD 253.1 MM.

Discounted Greenbriar’s Share of Present Value of Free Cash Flow: USD 71.5 MM.

11 – THE GREENBRIAR TEAM

Greenbriar has assembled an experienced team across the relevant skill sets of real estate development, green energy, project management, and business building:

Jeff Ciachurski – CEO and Board Member

Jeff Ciachurski is the principal executive officer representing the operating and management team to the board of directors. Jeff formulates the mission statement, growth plans, appoints and designates senior management personnel, defines geographic areas of responsibility, and engages senior independent consultants. He maintains continuous and proactive relationships with leading retail and institutional shareholders, and maintains close associations with the banking and project finance community. Jeff launched Greenbriar after a highly successful 11-year career as the founder and CEO of Western Wind Energy Corp, where he built a concept with a few thousand dollars and grew the company into an industry-recognized, vertically integrated, renewable energy owner and operator which he sold to Brookfield Renewable Energy Partners for CAD 420 Million in March 2013. Jeff established the operating and development assets in California, Arizona, and the Commonwealth of Puerto Rico and financially led and built over 165 MW of solar and wind production, 360 MW of advanced staged assets, and a 1,600 MW project pipeline, all wholly owned by the company. Jeff has a combined acquisition, development, financing, and shareholder value creation record of over USD 3.6 Billion.

Richard Phillips – Head of Greenbriar Construction

In 25 years of residential development and construction in Kern County, Richard has managed, consulted, and constructed over 2,500 homes. Upon graduating from California State University Bakersfield with a BA in Business Administration, he began his construction career with a national home building company, Centex Homes. He managed the construction of an average of 200 homes a year across multiple neighborhoods. While employed with Centex Homes, Richard acquired his CA General Contractors License (B1 #848124). Prior to operating his own company, he held the title of Division President for S&S Homes of the Central Coast. As Division President his role included but was not limited to land acquisition, land development, zoning and planning, project budgeting, and analysis of company profitability. He prepared bank Proformas for bank lenders and worked with city and county inspectors, architects, and surveyors.

At any given period, Richard managed up to five large-scale sites and up to 50 employees. 2017 was the year he left S&S Homes of the Central Coast to pursue self-employment. He founded Richard Phillips Construction LLC and his first big project was completing the Tyner Ranch Development. He completed phases 3, 4, and 5 which consisted of approximately 200 single-family residential homes. Richard draws from his experiences and training in the field, professional education, and ability to communicate fluently in English and Spanish which increases his performance efficiency. He takes pride in contributing to the realization of home ownership for thousands of families throughout Kern County.

Cliff Webb – President and Director

Cliff is a Registered Professional Engineer with 40 years of power engineering experience directly applicable to regulatory, EPC, and financing renewable energy development. Formerly Executive Vice President of Luz Development and Finance Corp., Cliff served as the principal executive tasked with developing, permitting, building, and financing the 355 MW SEGS solar thermal facility in Mojave, California (first of its kind in the US) and the largest project of its kind for 30 years. Cliff is also the former Manager of renewable energy procurement with Southern California Edison in which he executed over 2,500 MW of renewable energy contracts negotiated and built in California from 2007 to 2015. Cliff is the former Chief and Head of the Engineering and Environmental Division of the California Energy Commission and served as the personal Nuclear Energy Advisor to the Governor of California. Cliff holds a Mechanical Engineering degree from the University of California at Berkeley. Cliff funded, contracted or co-led over USD 10 billion in renewable projects since 2003.

Daniel Kunz – Chairman

Daniel Kunz PE, MBA, B.Sc. Eng. has 35 years of experience in areas of engineering, management, accounting, finance and operations. In 2014, he founded and is currently the managing member of Daniel Kunz & Associates, LLC an engineering services company in natural resources. He was the Director, President, and COO of Ivanhoe Mines Ltd. (NYSE: TRQ). In 1998, Daniel led Ivanhoe into Mongolia where, in 2001 he was part of the team that discovered Oyu Tolgoi, one of the largest copper-gold deposits in the world. He is the founder, and from 2004 until April 2013 was President, CEO, and Director, of U.S. Geothermal Inc., a renewable energy company acquired by Ormat Technologies (NYSE: ORA) in 2018 for an enterprise value of USD 200 million. U.S. Geothermal Inc. developed, owns, and operates 50 MW of base load power from three geothermal power plants. In 1993 as president, CEO, and director, he led the IPO of MK Gold Company on the NASDAQ, a gold company he co-founded with worldwide gold mining operations and production of 200,000 ounces of gold per year from the mines it owned and operated. For 17 years, Daniel worked for and ultimately served as a senior executive of Morrison Knudsen Corp (now USD 20 billion AECOM, NYSE: ACM), including as Vice President & Controller. In 1995, he was named a Distinguished Alumni from the University of Montana Tech (formerly the Montana College of Mineral Science and Technology) and was a member of the advisory board for the Engineering Department at the University of Montana Tech. He currently serves on the board of directors of several public companies involved in natural resource development including recently retiring as CEO of Prime Mining Corp. hosting 3 million ounces of gold, where he now serves as Director.

Anthony Balic – Chief Financial Officer

Anthony is a Professional Chartered Accountant, CA, and a CPA. Anthony has over 15 years of public company audit and financial management experience, including serving as a former Deloitte Audit Manager. Anthony has audited dozens of public companies including Western Wind Energy Corp., during the past 15 years, and currently represents several international resource companies as their financial executive.

Michael Boyd – Director

Before joining Greenbriar Sustainable Living in 2011, Mike held the position of Executive Vice President of Land Development for Western Wind Energy Corp., until the company was purchased by Brookfield Renewable Energy Partners in 2013 for CAD 420 million cash. He assisted Western Wind Energy in acquiring, leasing, and zoning real estate suitable for the development of wind and solar farms in Arizona and California. In addition, Mike served on the company’s Board of Directors.

Prior to joining Western Wind, Mike served for eight years as an elected member of the Pima County (Greater Tucson, Arizona) Board of Supervisors, elected to help run a county of one million residents with an operating budget of over USD 1 billion. Mike’s primary role for eight years, in addition to forming public policy, was his direct approval and entitlement of over 10,000 homes in the Greater Tucson area. Mike has extensive experience working with the largest real estate developers in Arizona, including all the national builders. Previous to his eight years as County Supervisor (two years as Chairman) Mike was elected for four years as the Pima County Land Recorder, in which he led a staff of 40 professionals in the recording and documentation of all of the real estate in Pima County.

Bill Sutherland – Director

Bill was Vice President & Senior Managing Director at Manulife Financial where he headed the firm’s Project Finance & Infrastructure Team. He and his team at Manulife have been leading arrangers and providers of debt and equity financing to the independent power sector for over 18 years. He is a seasoned corporate banker with over 37 years of business development, relationship management and corporate and project finance experience. Bill started as an analyst within The Bank of Nova Scotia’s International Corporate Finance Group in 1980 where he focused on project finance. He later created and led project and corporate finance teams at Chase Manhattan Bank, Mitsubishi Bank, and Deutsche Bank where he specialized in financing projects and mergers and acquisitions within the mining and metals, forestry, oil & gas, pipeline, and power sectors. In 1998, Bill acted as a consultant to Barrick Gold Corporation as Barrick explored the possibilities of creating a mine finance business in competition with the major commercial banks. Bill joined Clarica Life Insurance Company in 1998 where he created and headed a project finance team dedicated to financing power and infrastructure projects in Canada. Following its success in the Canadian market, the group broadened its focus and became a pioneering and leading arranger and provider of financing to the Canadian and U.S. wind power industries. The team moved to Manulife in 2002 and since that time expanded its leadership role within the Canadian independent power and U.S. renewable power markets. Bill is a Professional Engineer (AEPO) and holds a BSc. (Mechanical Engineering) and MBA from Queen’s University, Kingston.

Chris Harvey – Director

Chris was previously CEO of JP Morgan Securities (part of JP Morgan Chase, NYSE: JPM, USD 4 trillion AUM). Chris began his career at JP Morgan 39 years ago, and helped build out the firm’s overall investment banking capabilities. His roles included client banker, head of foreign exchange options and emerging markets derivatives, and he then built an advisory and solutions team focused on corporate finance valuation, as well as tax and accounting efficiency. He was also responsible for reputational risk for the firm’s investment bank in the Americas. After spending several years as the Chief Country Officer for Japan, Chris then ran the Wealth Management business for Latin America, with his final position as the CEO of JP Morgan Securities for four years. Chris is from Columbus, Ohio and holds a degree in Economics from Harvard College. He is on the board of directors of Atmonia, an Iceland-based pioneer in zero-carbon ammonia production.

Advisors

Paul Morris – Independent Head of Sales for Sage Ranch

Paul is a significant Keller Williams’ Regional Owner for Central & Southern California, where he oversees 36 offices with 8,000 realtors who close USD 18 billion in sales volume per year. Additionally, as CEO of Forward Living, Paul has grown his own offices to become Keller Williams’ #2 Franchisee with 3,000 realtors and USD 7.8 billion in annual closed volume. Paul and his team have led Keller Williams Realty to the #1 spot for Market Share in Los Angeles. Real Trends 500 ranks Paul’s group as the 24th largest real estate brokerage firm in the U.S. and the 2020 Swanepoel 200 ranked Paul as the 64th most powerful person in residential real estate in the U.S. Paul is a prolific entrepreneur, real estate investor, author, trainer, and business consultant. He is the author of the New York Times bestselling book Wealth Can’t Wait (www.wealth.org). Prior to real estate, Paul had a successful legal career – highlights include his work at the international law firm Proskauer Rose, and as Senior Counsel at the U.S. Department of Justice consistently reporting to the U.S. Attorney General and Counsel to the President. Paul has a degree in economics from University of Pittsburgh, a Masters in Management from Oxford University, and a JD from Cornell Law School.

Keith Martin

Keith Martin is the Co-Head of Energy Projects for all of Norton Rose Fulbright, LLP, the second-largest Law Firm in the US. Keith is a transactional lawyer whose principal areas of practice are tax and project finance. He acted for 116 companies last year. He also lobbies Congress and the Treasury Department on policy issues. The prestigious Chambers directory has called him “the preeminent authority on tax structurings in the US” and gives him its sole “star” ranking among U.S. renewable energy lawyers. Keith holds a M.Sc, from The London School of Economics, a JD, from George Washington University, and a BA from Wesleyan University. Keith has provided legal and tax structuring on over USD 100 Billion of renewable projects since 2003.

Tommy Sullivan – Chairman of Real Estate Advisory Board

Co-Founder – Title Ventures. Title insurance joint venture company. 15 agencies and growing.

Director and Investor – Enexor. Technology that converts plastic, refuse, and biodegradables into energy without carbon emissions.

Director – Data Services. A title software company.

Co-owner/Founder – Brilliant Health. Biopharma / R&D/ Product development.

Investor/advisor – QUSecure. Post-quantum resilient cyber security company protecting against Classical and future Quantum computer attacks for companies, Infrastructure, Satellites, and Military.

Former Chairman – Title Security Agency for 20 years. Sold to First American.

Former Chairman – Landmark Title Assurance agency. Sold to Shaddock National and current Director.

Disclaimer

The information contained in this analysis and all the related resources, interviews, comments, and articles available on https://spaarvarkens.be (‘this content’) are not intended as, and shall not be understood or construed as, financial advice.

The author is not a lawyer, accountant, analyst, fiscal or financial advisor. Nor is the author holding himself out to be. The information contained in this content is not a substitute for financial advice from a professional who is aware of your own individual situation.

The author has done his best to ensure that all the information provided in this content is accurate and provides valuable educational insights. Feel free to reach out at [email protected] if you spot any mistakes and he will gladly correct them.

This content is intended to be used for information and education purposes only. Always do your own independent research and don’t rely on this content. The author is not liable for any damages, expenses, or losses you may suffer arising out of this content or any reliance you may place upon it.

The author has no obligation to follow up on this content and believes in individual empowerment, not in hand-holding.

The author owns 152,600 shares of Greenbriar Sustainable Living Inc. The author is not paid or compensated by the company for this content. The author will not trade Greenbriar in the first 3 days after the publication of this content on https://spaarvarkens.be.

Be aware that losing one’s shirt is a real risk when you invest in stocks.

The author is a private investor with 25 years of experience in the stock markets. In 2020, he co-founded Spaarvarkens, the largest investment-related educational community in Belgium.

Published in Aandelen, Beleggen, Fundamentele Analyse, Gratis, Nieuws

Nice one, Sven! Thanks for this solid analysis! Go, go, Greenbriar! I challenge anyone to find out what’s wrong, here. Seems to be a seriously undervalued company with some solid assets, doesn’t it? And yet it remains a company that has not been picked up by investors yet. Why? Because investors only care about the magnificent seven and AI, these days? I have a limited position and will hold it. I am patient.

Thank you Sven for the detailed breakdown of the current situation and what we may expect in the next 5 to 10 years.

Prachtig artikel, Sven. Bedankt!

Dag Sven,

Zeer mooi artikel met alle info hapklaar geserveerd. Bedankt!

Een vraag: Waarom is de rechtzaak met het water district over de waterrechten voor Sage Ranch niet geïdentificeerd als risk in het artikel? Is er een plan B indien dit niet uitdraait zoals Greenbriar & the city councel verwachten? Wat is het worst case scenario mbt dit aspect?

sven, proficiat met je artikel en je optreden in de spamalot!

klasse!

zal weer in greenbriar moeten stappen denk ik!!

[…] Sven Vande Broek has a European newsletter and just wrote a very in-depth analysis of Greenbriar. I have known Sven for several years through email, and he has graciously shared his report. You can view the complete 24-page analysis here. […]

In accordance with the disclaimer at the bottom of this article from 2 years ago I would like to announce that, as of the day before yesterday, I now have 245,981 Greenbriar shares in my portfolio.